5 months ago, I was trapped by a lengthy commute to work, the grey walls of a prison cell, errr, cubicle, and the typical degradations that come with a corporate gig. My insides would try to claw their way out when I used all my willpower to remain seated in my ergonomic office chair. On countless random weekdays, I had half a mind to get up from my seat at 3 p.m., pulling an Office Space and just walk the hell out. I would fly to a tropical beach, order a Mai Tai and work on creative things that inspired me!

But I didn’t. Why not? Well, the corporate world is a gnarly beast to free yourself from. If I just walked out randomly, I’d likely be crawling back begging for a job again very soon because there are chains that come with corporate life. It requires a hefty financial commitment just to do the work. You need to commit with a second set of corporate clothes, money for transportation, typically at least 10 hours of your weekdays and an expensive lifestyle that accommodates for your lack of free time. A corporate job then becomes a self-reinforcing cycle, but there are things you can do today, right now to put you on the path to GTFO.

I’m writing to you today from Japan. 2 weeks ago, I was in Taiwan picking up delicious scallion pancakes for breakfast from a small alley shop. One month ago, I was spending Christmas on Patong Beach, Thailand having cocktails with a bunch of Swedes. 6 weeks ago, I was crewing a sailboat from Malaysia to Thailand. 2 months ago, I laughed so hard I wet my pants in Ireland listening to stories with new friends over dinner and drinks. 4 months ago, after a bit of preparation, I pulled an Office Space. That is, I left work after putting in a couple weeks’ notice and long after doing these next steps. These are things you can do Right Now and they make sense to do even if you don’t eventually knock down your cubicle walls.

1. AUTOMATE YOUR SAVINGS — If you’re not going to have a steady income, you’re obviously going to draw from your savings for a while lounging on that Thai beach. Time to fatten up your account!

If your employer offers direct deposit to multiple accounts as a payment method, this can be a ridiculously easy step. As I slowly realized that quitting my job and not having another one to jump to was a definite possibility, I bumped up the amount that went to my savings account. I think I started with $50 from each paycheck, then $100, then $200.

Automatically allocate as much as you can to a savings account and try not to touch it unless you have an emergency. By having your savings separated without you thinking about it, it’s easier to forget about. Consequently, you’ll more easily live within the means of a new budget: your slightly smaller checking account. Meanwhile, your savings account grows and you barely notice the pinch! It really works.

Why it’s smart even if you don’t quit your job: in this volatile world, it’s just smart in general to have padded savings. Do you have enough cash to cover at least 6-months worth of living expenses? Lay-offs happen. Illnesses happen. Shit luck happens. There are no guarantees other than at one point or another, it’s going to be good to have more in savings than you could foresee needing. CYA!

2. GET A FRESH PASSPORT — Getting a passport takes a while, and you’re not going to want to wait around for it when you’re ready to make the leap. Apply for it today!

https://travel.state.gov/content/passports/en/passports/apply.html

Even if you have one now, when you travel, you often need your passport to be valid for 6 months from when you arrive in a country, or even several months after you intend to leave. Luckily, you can renew your passport now, even if it hasn’t expired. Go to this U.S. Department of State link for more info: https://travel.state.gov/content/passports/en/passports/renew.html

Why it’s smart even if you don’t quit your job: you can still be spontaneous even if you work full time! If you don’t have a passport, though, your spontaneity is drastically limited. Plus, there are new U.S. rules about ID’s coming out that will make life in general more of a pain if you only have a driver’s license from certain states as ID. You can see a current list from the Department of Homeland Security about which states’ ID’s are cool with Big Brother here: http://www.dhs.gov/current-status-states-territories

3. REDUCE YOUR DEBT — Debt, specifically student loan debt, was the biggest burden holding me back from quitting my job and traveling the world sooner. There are 2 easy ways you can start hacking away at the binding ties of debt.

For typical credit debt, say a credit card you carry a balance on, it’s best to automate the payments. It works just like the method for fattening up your savings – you have as big of a chunk as you can manage pulled from your available cash without your involvement. Then, when you look at how many dollars you have in your checking account, your mind will automatically work within the new budget. Bump up those payments as much as you can tolerate! You want to be 100%, completely free of credit card debt if you quit your job.

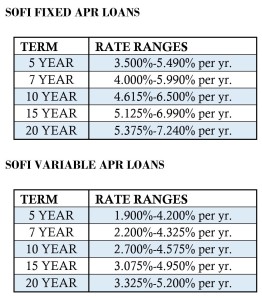

For student loan debt, there are some fantastic, new refinancing options out there! If you just want to pay down your debt faster and don’t plan on quitting your job, you may be eligible to dramatically reduce your interest rate. 6 months before I quit my job, I refinanced with the goal of paying off my student loans as soon as possible. I chose terms that were as fast as I could manage. That means, I chose terms with the highest monthly payments I could afford. Typically, the shorter the payback term, e.g., paying back in 5 years versus 15 years, the less you pay per month in interest.

Later, when I realized I would not be jumping to a new, better-paying job, I went the opposite way with my student loans. Knowing I would likely not have an income soon, I refinanced with the longest terms possible. This pushed my final payment way out to 20 years in the future, and raised my interest rate slightly, but I was paying over $200/month less, and that means I could stretch my savings out a whole lot farther. Plus, I was STILL paying less in interest than if I had stayed with Sallie Mae/Navient. Refinancing to get away from those companies was a no-brainer.

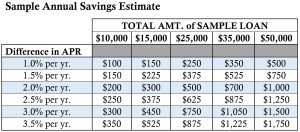

Check out the rough estimate chart below for examples on what you could save per year. If you reduce your interest rate by 1%, 1.5%, 2.0%, etc., in the column on the left, you can follow the row over to the right to see about how much you would save per year on a loan of $10,000, $15,000 or $25,000, etc.

Annual Savings Estimate from Student Loan Refinancing

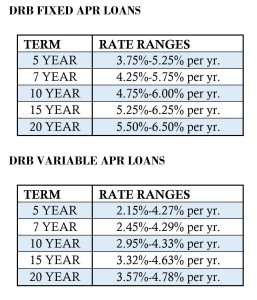

I’ve tested out 2 companies myself and had great results. If you use THIS LINK to refinance with SOFI, it counts as a referral from me. I get a finder’s fee and you get $100! DRB is another great company where you may be able to get slightly better terms and rates, and you can get referred by me by sending me your info here.

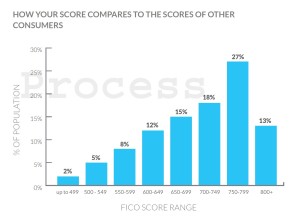

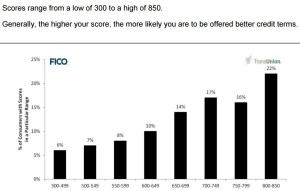

You do need excellent credit to qualify for both of these refinancing options, so do it now, while you still have a job! Check out both companies and see which gives you the better offer.

Why it’s smart even if you don’t quit your job: paying interest is like flushing your money down the crapper! Why pay more than you have to? The faster you pay off your debt, and the lower the interest you are charged, the more cash that stays in your pocket. That just plain makes sense — no matter what your situation!

It takes a lot of planning to successfully pull off the type of sabbatical many of us dream of, but these 3 things are huge yet simple steps to take to make it possible. Plus they just make sense in general! Do them early. Do them now!

If you have more questions about taking a much-needed sabbatical, money management, or anything else, please let me know in the comments below.